ESG Investing in the Spotlight

It’s probably safe to say that most people choose an investment with an eye toward adding financial value to their portfolio. Over the past two decades, however, many investors have added another layer of values in making investment decisions. The most common criteria are related to environmental, social, and corporate governance issues, typically referred to as ESG factors.

More recently, ESG investing has become controversial, primarily due to large institutional investors such as universities and pension funds using ESG factors to construct their portfolios. Critics say that this approach compromises potential returns, while proponents claim that better ESG practices may help lower risk and provide more stability without sacrificing performance.

As an individual investor, the choice to apply personal values to your investments is entirely up to you, and it may be helpful to know more about this approach.

What’s in a name?

Values-based investing was originally called Socially Responsible Investing (SRI), and this term is still commonly used. Other terms, often using the SRI acronym, include sustainable and responsible investing; sustainable, responsible, and impact investing; or simply sustainable investing. The emphasis on ESG factors developed as a way to analyze companies in constructing funds or portfolios.

SRI and ESG are often used interchangeably, but some analysts see them as two separate practices. According to this view, SRI takes more of a pure values-based approach in screening potential investments; for example, it might screen out companies involved in tobacco, weapons, or fossil fuels extraction and screen in companies that produce “green” products or focus on financial inclusion or health. ESG looks at these factors more in terms of risk management and financial performance; for example, a company with poor labor relations could face a workers’ strike and a company with poor waste management could be fined or constrained with government regulations.

Investments and performance

ESG strategies are often applied by professional managers for large institutional investors, but individual investors might consider these factors when developing their own portfolios. Along with screening individual stocks, investors can choose from more than 650 ESG/sustainable funds.1 As with any fund, it’s important to understand the objectives and criteria for choosing investments. Funds labeled ESG, sustainable, or socially responsible can vary widely in their objectives, in how they define and evaluate ESG factors, and in how strictly they apply selection criteria.

It’s difficult to assess the effect of ESG factors on investment performance, because there is no standard definition of what companies or investments should be included in an ESG analysis. A review of more than 1,000 research studies published from 2015–2020 reported that 33% of studies that focused on investment results found a positive correlation between ESG and performance, 26% reported a neutral impact, 28% were mixed, and just 14% found a negative correlation.2 The S&P 500 ESG index, which includes more than 300 of the S&P 500 companies based on ESG scores, outperformed the full index in eight out of 10 years from 2014 to 2023.3

Top Issues

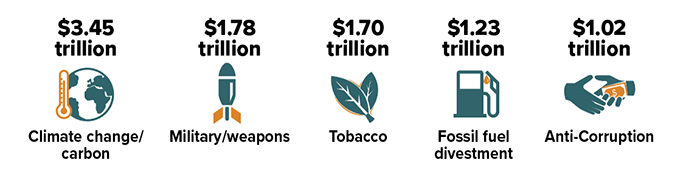

In 2022 (most recent data), about $8.4 trillion of professionally managed U.S. assets incorporated ESG criteria in choosing investments and/or filing shareholder resolutions. These were the leading criteria used by money managers, based on the value of assets to which they were applied.

Source: US SIF Foundation, December 2022

Limiting the universe

Although many companies and funds consider ESG factors, focusing on these strategies limits the total universe of available investments and could make it more challenging to diversify and maintain your desired asset allocation. Like all investments, SRI/ESG stocks and funds entail risk and could lose money, and there is no guarantee that an SRI/ESG investment will achieve its objectives.

Diversification and asset allocation do not guarantee a profit or protect against loss. Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.