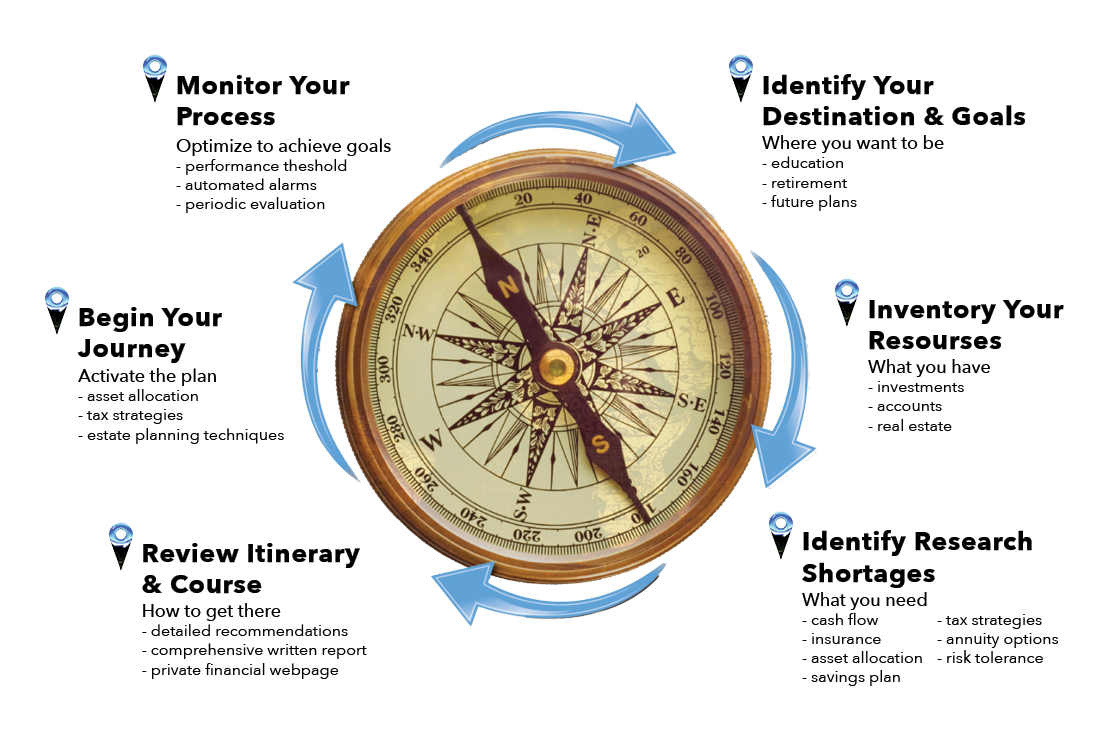

A Relationship Driven Financial Planning Process

Achieving your goals allows you peace of mind to be actualized and your stress is minimized. You are free to live with less stress and more enjoyment.

Portfolio Management

Investment Selection

We’ll get to know your personal financial philosophies and your specific investment interests to guide us on making the best choices for you. Choosing individual investments requires time, research, and monitoring, so let us put our knowledge and experience to work!

Advisory Options

Sometimes it’s better to look at the bigger picture and choose a portfolio that offers more advisory services. This could be a portfolio that automatically adjusts itself to your timeline, focuses on specific industries, or even offers special features that monitor market patterns.

Retirement Planning

Retirement today takes on a whole different look than decades ago. Today, many people what to know “if” they can retire, not just “when”. Today’s retirees are presented with many options on how to spend their “golden” years. We work with you to set goals and generate the income and lifestyle you desire.

This is not a one-size-fits-all approach. You have worked hard to build during your working years. We strive to help you make your money work. Whether you choose to retire early, start a second career (because you want to), or go further, we will coordinate a plan for you.

Multigenerational Planning

Your legacy is more than a number on an account statement. It involves everything that is important to you. Multigenerational planning is a holistic approach that takes into consideration the needs of all age groups throughout all stages of financial planning. It provides navigation from the summit. Our approach will assist older generations who have successfully passed through the wealth accumulation and protection stages of their life.

You want to ensure that your lifetime efforts are strategically positioned. In the wealth distribution phase, seniors with substantial net worth, including real estate and closely-held businesses, may face substantial estate taxes that can ultimately deplete their estate. Let us to assist you in creating a plan to preserve and pass on your legacy for future generations!

Send us a message: