A Holistic Approach to Building, Protecting, & Managing Wealth

Financial success begins with a clear, customized plan. We help you:

✔ Define and prioritize short-term and long-term financial goals.

✔ Create a cash flow strategy to optimize savings and investments.

✔ Align your wealth management plan with your lifestyle needs and future objectives.

✔ Make informed decisions through ongoing financial guidance.

Retirement planning is more than just saving—it’s about ensuring lifelong financial security. Our approach includes:

✔ Developing a retirement income strategy tailored to your needs.

✔ Managing 401(k), IRA, and pension distributions.

✔ Helping you optimize Social Security and other benefits.

✔ Planning for healthcare and long-term care costs.

Your legacy is more than your assets—it’s the impact you leave behind. We help you:

✔ Structure your estate plan to minimize taxes and maximize generational wealth.

✔ Coordinate with legal professionals to ensure your wills and trusts are in order.

✔ Create a plan for charitable giving and philanthropic efforts.

✔ Ensure a smooth transfer of assets with succession and wealth transfer strategies.

Taxes play a significant role in financial planning. We work with you to:

✔ Implement tax-efficient investment strategies.

✔ Reduce tax liabilities through structured withdrawals and gifting strategies.

✔ Collaborate with CPAs to help ensure tax planning aligns with financial goals.

✔ Optimize your portfolio for long-term tax efficiency.

Financial success begins with a clear, customized plan. We help you:

✔ Define and prioritize short-term and long-term financial goals.

✔ Create a cash flow strategy to optimize savings and investments.

✔ Align your wealth management plan with your lifestyle needs and future objectives.

✔ Make informed decisions through ongoing financial guidance.

Retirement planning is more than just saving—it’s about ensuring lifelong financial security. Our approach includes:

✔ Developing a retirement income strategy tailored to your needs.

✔ Managing 401(k), IRA, and pension distributions.

✔ Helping you optimize Social Security and other benefits.

✔ Planning for healthcare and long-term care costs.

Your legacy is more than your assets—it’s the impact you leave behind. We help you:

✔ Structure your estate plan to minimize taxes and maximize generational wealth.

✔ Coordinate with legal professionals to ensure your wills and trusts are in order.

✔ Create a plan for charitable giving and philanthropic efforts.

✔ Ensure a smooth transfer of assets with succession and wealth transfer strategies.

Taxes play a significant role in financial planning. We work with you to:

✔ Implement tax-efficient investment strategies.

✔ Reduce tax liabilities through structured withdrawals and gifting strategies.

✔ Collaborate with CPAs to help ensure tax planning aligns with financial goals.

✔ Optimize your portfolio for long-term tax efficiency.

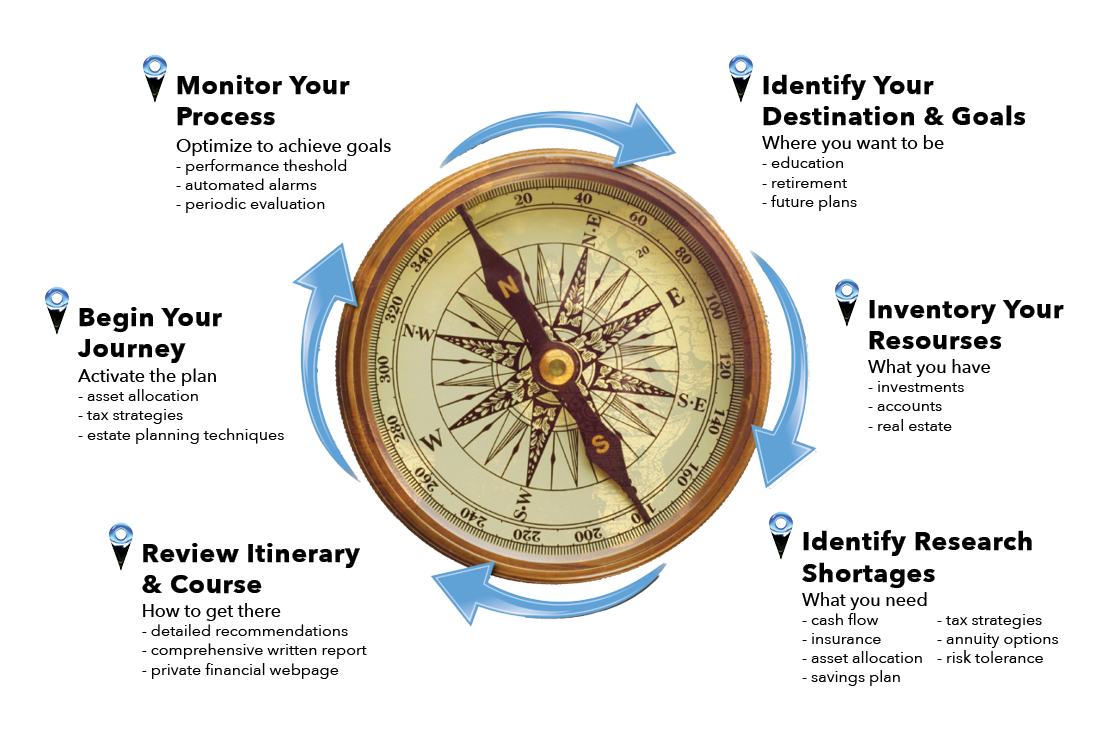

A Relationship Driven Financial Planning Process

Achieving your goals allows you peace of mind to be actualized and your stress is minimized. You are free to live with less stress and more enjoyment.

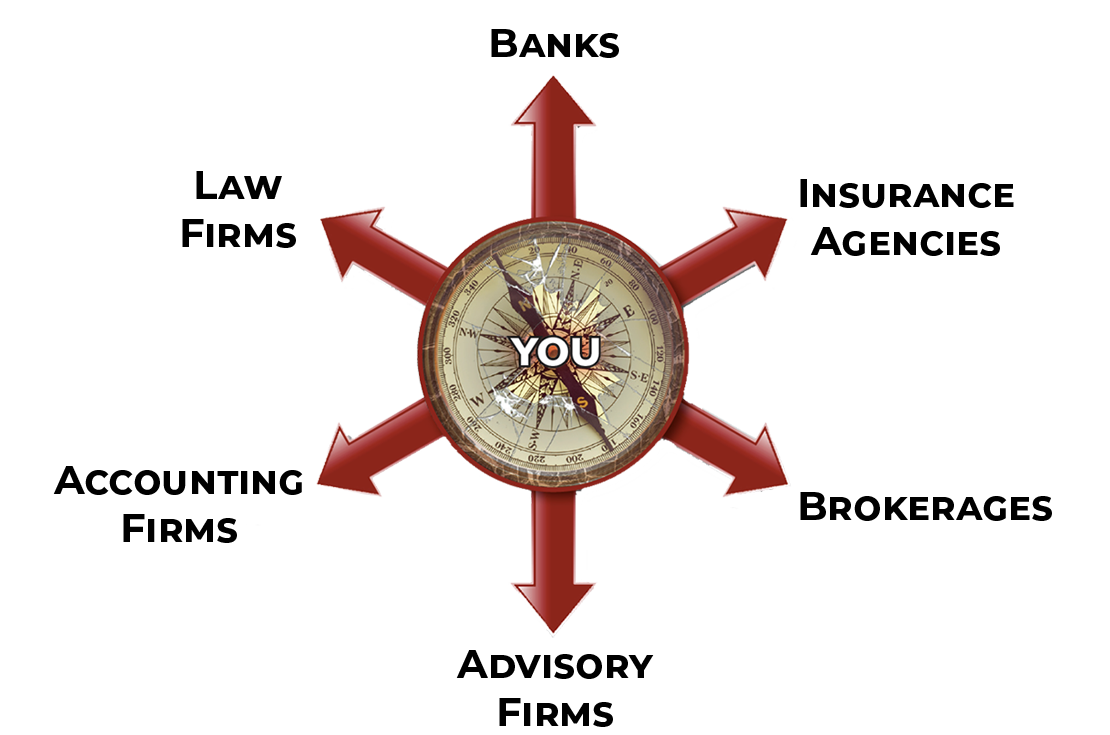

A Relic of The Past

Isolation Model

The isolation model creates barriers and complexity. Financial plans and strategies may be developed without having all the pertinent information. You, the client, carry the burden of juggling information from multiple professional sources. Many advisors use this model, but we are more focused on your experience.

You shouldn't face complex tax and investment strategy decisions alone or have to coordinate the juggling act. We take a more holistic approach.

Simplified For You

Holistic Functional Model

The holistic functional model places the advisor directly beside the client in their financial journey. Advisors using this model value coordinating with other professionals on your behalf, allowing you the peace of mind and freedom of having a financial team that truly works for you & with you.

Leave the juggling act behind and let our team orchestrate your financial journey.