Aligning with Your Strategic Objectives!

Our Financial Institution Allies

Our bank and credit union partners are at the core of our mission, driving us to deliver tailored financial solutions that align with their strategic objectives. We are committed to fostering long-term relationships founded on trust, collaboration, and mutual success, empowering them to thrive in a rapidly evolving financial landscape.

Solutions — Simplifying Success through Partnership

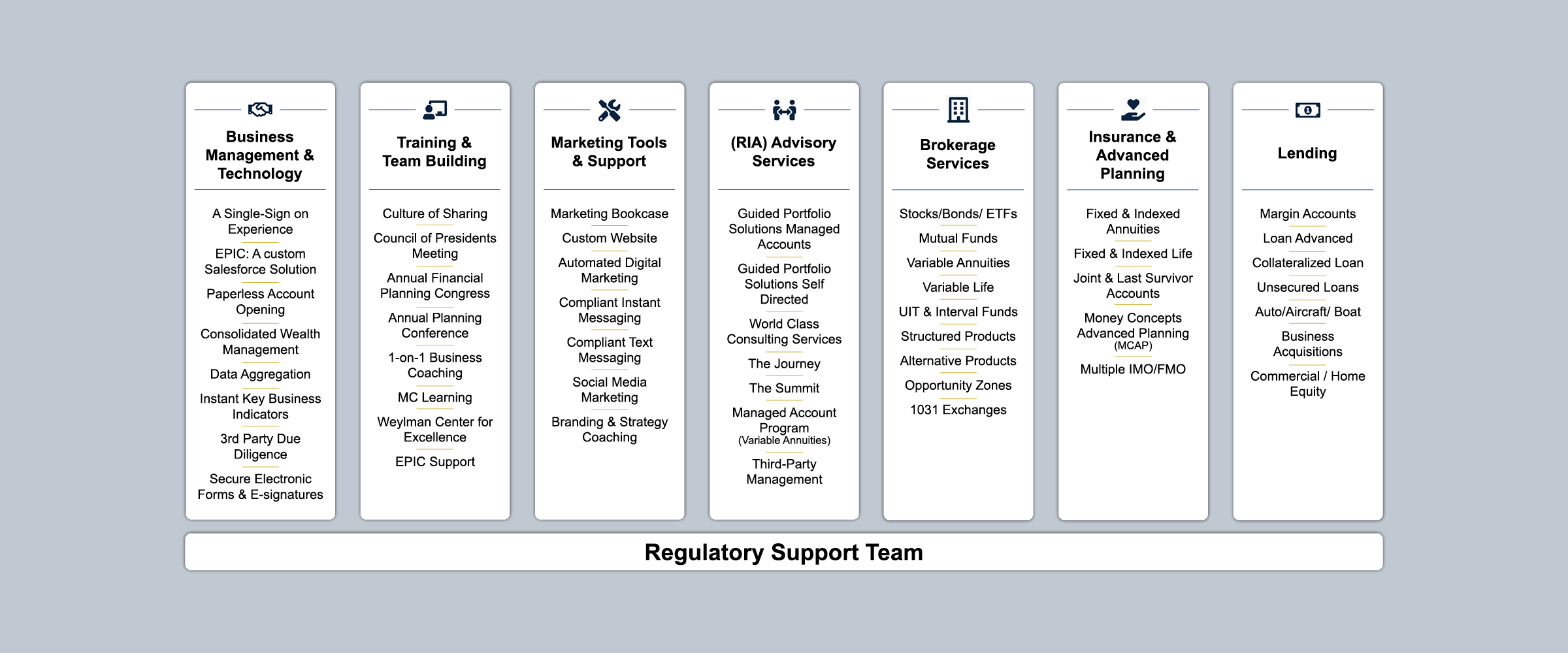

Financial Institution Solutions

Money Concepts offers tailored solutions for financial institutions, including banks and credit unions, to enhance their financial service offerings. Our comprehensive approach ensures that institutions can seamlessly integrate our services while benefiting from extensive marketing support and advanced technology.

CUSTOMIZABLE FINANCIAL PROGRAMS: Tailored programs for integrating financial planning and investment services within the institution.

WHITE-LABELING OPTIONS: Opportunity to provide Money Concepts’ services under the institution’s own brand.

CLIENT ACQUISITION AND RETENTION TOOLS: Strategies to strengthen client relationships and attract new customers through enhanced service offerings.

TECHNOLOGY INTEGRATION: Integration with the institution’s existing systems for an improved client experience.

COMPLIANCE & RISK MANAGEMENT: Extensive support to ensure all financial offerings adhere to regulatory requirements.

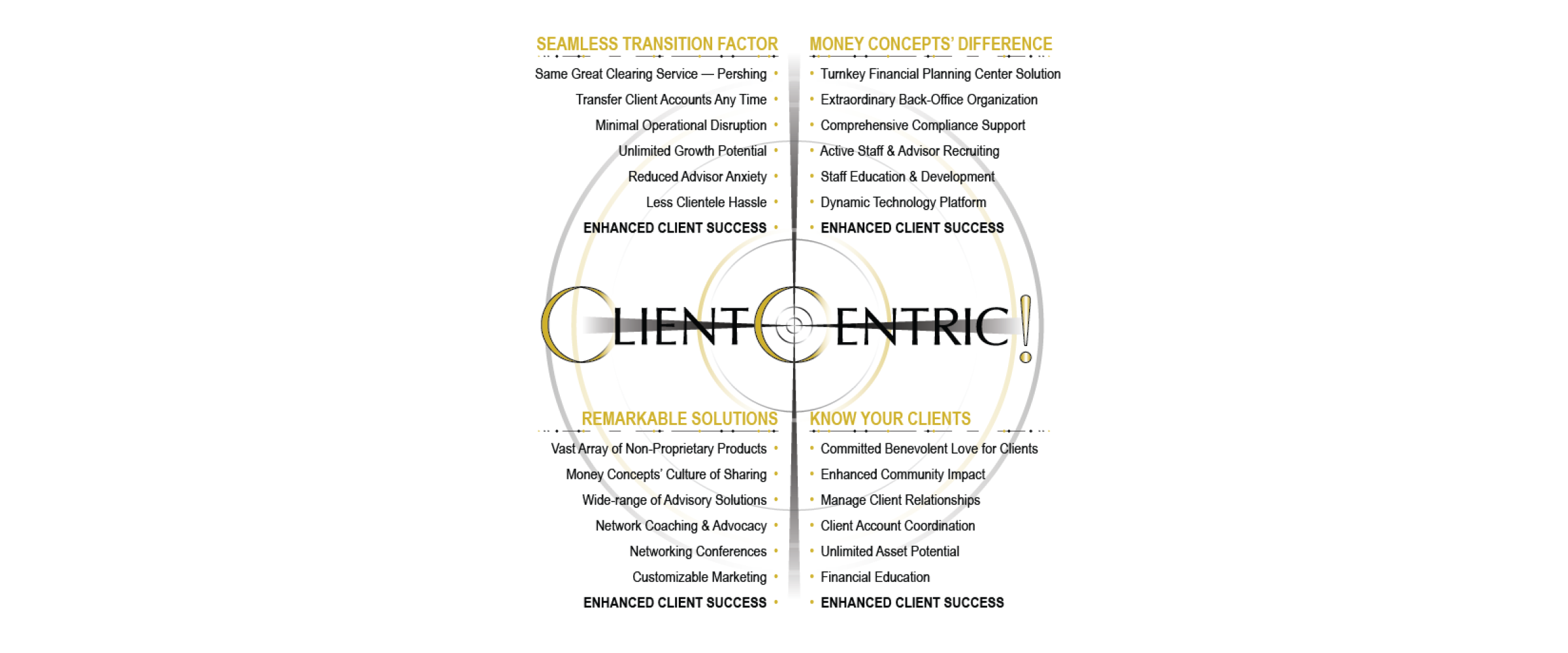

Client-Centric Solutions—Tailored support and innovative strategies that put your clients at the heart of every decision

Are your Financial Institution (FI) and Broker-Dealer (BD) Advisory Solutions ClientCENTRIC?

Money Concepts has been helping banks and credit unions care for their clients with client-centric solutions since 1984. We are a full-service financial planning organization. Our wealth management and financial planning solutions enable FIs to offer financial planning services with proven systems and success. Through extensive BD back-office experience, your FI can focus on what matters—strengthening your client relationships through comprehensive wealth management, financial planning, estate planning, life insurance, and investment solutions.

When you need an answer fast!

MOMENTUMgroup Quick-Access Tools

Glossary

View GlossaryCalculators

View CalculatorsTax Glossary

View Tax GlossaryTax Calendar

View Tax CalendarTax Library

View Tax LibraryFederal Tax Forms

View Federal Tax FormsFederal Tax Publications

View Federal Tax PublicationsArticles

View Helpful ArticlesLearning

View Learning TopicsDiscover What Makes Us Different

Connecting Visions, Empowering Futures!

Let's Connect!

Your Institution. Our Partnership. Shared Success.