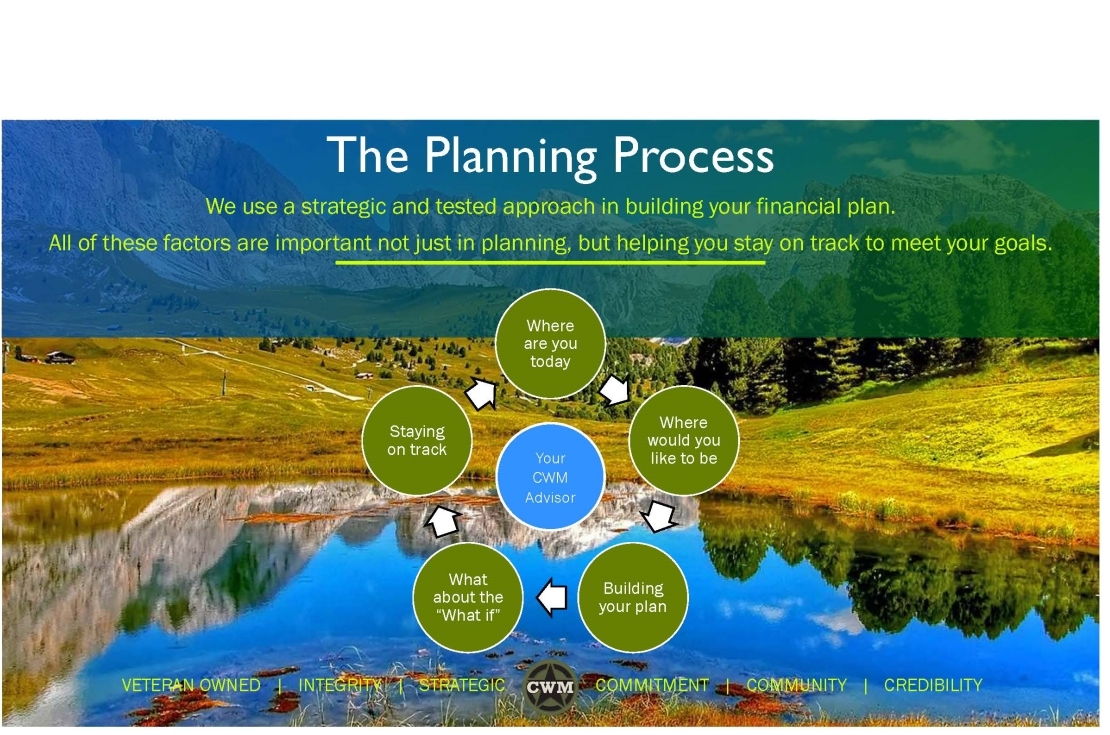

- Where are you today? - What is your current financial situation and goals? What do you have saved or invested, how are your investments balanced, do you have short and long term goals written down?

- Where would you like to be? - What are your short term and long term goals? Are they detailed and specific to your wants and needs, not the "cookie cutter" wants and needs you are told you should have? What age and lifestyle do you imagine when thinking about these goals?

- Building Your Plan - In this stage you and your Command Wealth Management planner build a financial plan that takes into consideration all of your financial needs and goals. Strategic planning is more than just investment selection, your financial planner will build a plan that addresses your goals, insurance plan, investment analysis, legacy plan, and estate plan. All of these elements will assist in building a financial plan specific to your needs.

- What about the "What If" - Inevitably life happens. Even the best laid plans will have to be adjusted as the changes of life impact your goals. Planning for this ahead of time is vital to your long term success. There will always be things that come up and make us change course at times, but we will help plan for many of these ahead of time.

- Staying on Track - We often consider this one of the most important steps. As the market fluctuates and so much economic or financial noise is thrust in front of us, staying on track is crucial. We are here to help you weather the storm and stay on track to what matters most to you.

During this entire process your Command Wealth Management Financial Planner is with you to encourage, advise, and implement your financial plan so you can focus on what matters most to you and your loved ones.