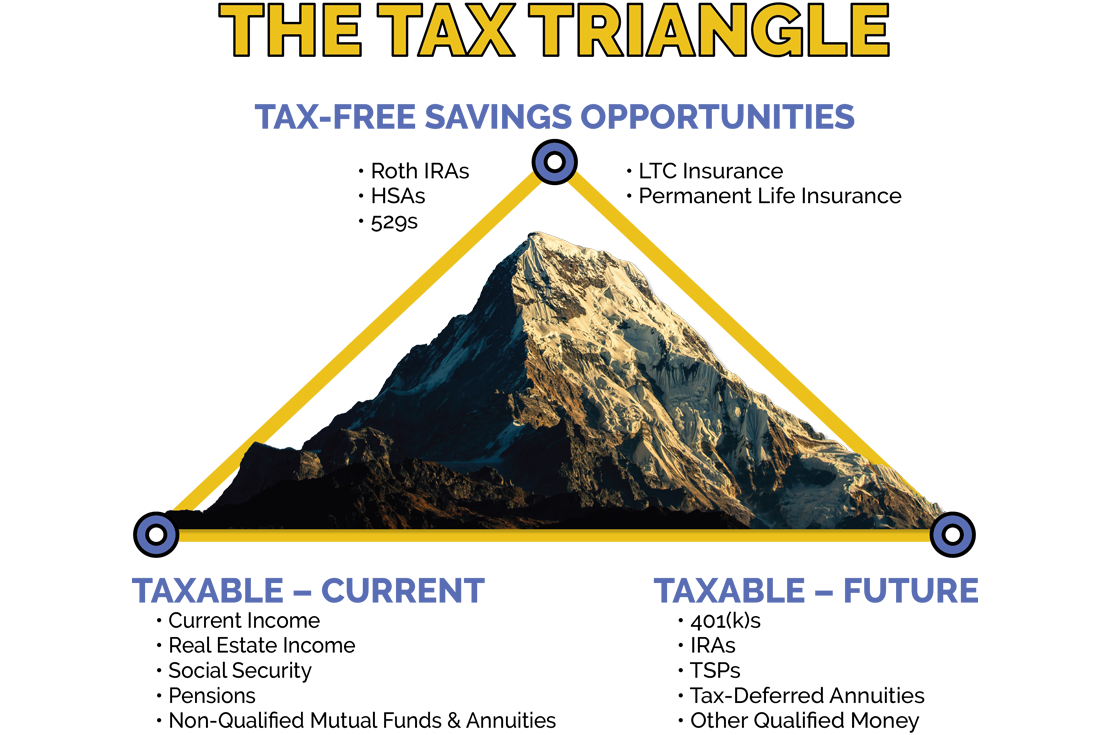

The Tax Triangle

One of the most valuable conversations we have with our clients is about tax consequences, both now and in the future. In most circumstances, taxes must be paid at some point, whether it be by you or your heirs.

Have you ever received a 1099 at the end of the year for a mutual fund that lost value during the year? Taxes can significantly reduce your investment returns if you’re not careful. Do you want the government telling you how much you can save for retirement? Do you want the government telling you when you can or have to withdraw those savings? While tax-advantaged retirement plans are many times the best choices for saving while we are working, they come with a lot of restrictions.

If you’d like to be in control of your life and legacy, a Money Concepts advisor can help you position your assets in the most tax-efficient ways possible. Let’s have a conversation to see what can be done to delay and minimize the overall tax burden for your family in your working years, retirement, and after leaving a legacy.

Contact us for more information.Have you ever received a 1099 at the end of the year for a mutual fund that lost value during the year? Taxes can significantly reduce your investment returns if you’re not careful. Do you want the government telling you how much you can save for retirement? Do you want the government telling you when you can or have to withdraw those savings? While tax-advantaged retirement plans are many times the best choices for saving while we are working, they come with a lot of restrictions.

If you’d like to be in control of your life and legacy, a Money Concepts advisor can help you position your assets in the most tax-efficient ways possible. Let’s have a conversation to see what can be done to delay and minimize the overall tax burden for your family in your working years, retirement, and after leaving a legacy.